What is Rhea Finance (RHEA)?

What is Rhea Finance?

(Source: rhea_finance)

Rhea Finance is not a brand-new protocol built from the ground up. Instead, it’s an upgraded platform formed by merging two of NEAR blockchain’s flagship native DeFi protocols: Ref Finance (DEX) and Burrow Finance (Lending). The aim is to create a more coordinated, efficient, and agile infrastructure that redefines the future of DeFi on NEAR.

Rhea is much more than a rebrand—it is a vehicle for technological innovation. By deeply integrating NEAR’s core technologies, such as chain abstraction and AI modules, Rhea serves as both the liquidity aggregation layer and the foundational financial application layer for the entire NEAR ecosystem.

Core Positioning and Technology Vision

Rhea Finance’s mission is to become NEAR’s most resilient and extensible DeFi infrastructure. Leveraging chain abstraction, AI-powered architecture, and a modular design, Rhea streamlines protocol integration and launches community incentive mechanisms with ease. It is designed to be the liquidity hub for all ecosystem projects, dramatically improving capital efficiency and enabling the protocol to effectively serve diverse assets, cross-chain users, and advanced governance models.

Dual-Pillar Product Architecture

Currently, Rhea consists of two core products: a decentralized exchange (DEX) and a decentralized lending protocol. These offerings, built on an entirely new protocol architecture and computational model, are engineered to maximize capital efficiency and enhance user experience.

Rhea DEX: Flexible, Open Automated Market Making

At the heart of Rhea’s trading capabilities, the RHEA DEX builds on a foundational AMM (automated market maker) model while enabling robust, user-driven customization, including:

Permissionless Liquidity Pool Creation: Anyone can launch a new trading pool, unconstrained by whether an asset pair already exists.

Customizable Pool Fees: Creators set their own transaction fees, making it possible to tailor fee models to different asset classes.

Slippage Protection: Users can define minimum output/maximum input for each trade, mitigating price slippage on large transactions.

Specified Output Swaps: Input the desired token amount to receive, and the system auto-calculates the required payment.

Multi-Pool Routing: Even without a direct trading pair, the protocol seamlessly routes swaps across multiple pools.

This architecture empowers liquidity providers with greater autonomy and offers users more precise, cost-optimized trade execution.

Rhea Lending: Customizable Risk Model Lending Market

On the lending side, RHEA Lending introduces multidimensional risk evaluation, allowing each asset’s parameters to align with real market dynamics:

Asset-Specific Volatility and Risk Models: Risk is no longer one-size-fits-all—parameters are tailored to each asset class.

Dynamic Interest Rate Curves: Lending rates auto-adjust in real time based on asset utilization, optimizing capital allocation.

Open Liquidation Mechanism: Protocol stability remains secure, while maintaining fairness and transparency.

Flexible Incentive Structures: Both lenders and borrowers are incentivized to participate, fostering a positive feedback loop.

These features enable Rhea to adapt to the unique traits of different assets and respond instantly to market shifts in rates or participation, dramatically boosting overall liquidity.

RHEA Finance Technical Architecture

Drawing inspiration from Uniswap v2, Curve Finance, and iZiSwap, RHEA Finance’s smart contract system integrates multiple mathematical models:

Traditional AMM Curve: x * y = k, forming the basic foundation for stable token swaps.

StableSwap Curve: Optimized for stablecoin trading, ensuring high-efficiency swaps between stable assets.

Yield-Bearing Asset Pools (Rated Pools): Custom-designed for yield-generating assets like stETH, with optimized logic for these swaps.

Discretized Concentrated Liquidity Model (Discretized CLAMM): Mirrors Uniswap v3/iZiSwap for higher capital efficiency.

All models run natively on NEAR’s blockchain, are open source, permissionless, and fully decentralized. Anyone may participate as a trader or liquidity provider by supplying equivalent asset value to receive LP tokens, redeemable at any time. Unlike Uniswap’s fragmented structure, Rhea’s unified contract design consolidates all pools and trading pairs under a single main contract (v2.ref-finance.near), streamlining system maintenance and scalability.

Community Governance and Participation

Rhea’s governance runs on a NEAR-based Sputnik DAO framework, featuring a dual-track structure:

Council: Manages proposal initiation and final decisions.

Community: Votes on all proposals, and the Council typically follows the majority community vote.

Beyond voting, Rhea proactively encourages community involvement across all project levels—project management, process planning, product testing, strategy development, market analysis, user support, community management, public relations, and ecosystem communications. This inclusive participation structure allows every user to play a role in the protocol’s evolution, providing a more actionable approach to decentralized governance.

RHEA Finance Tokenomics

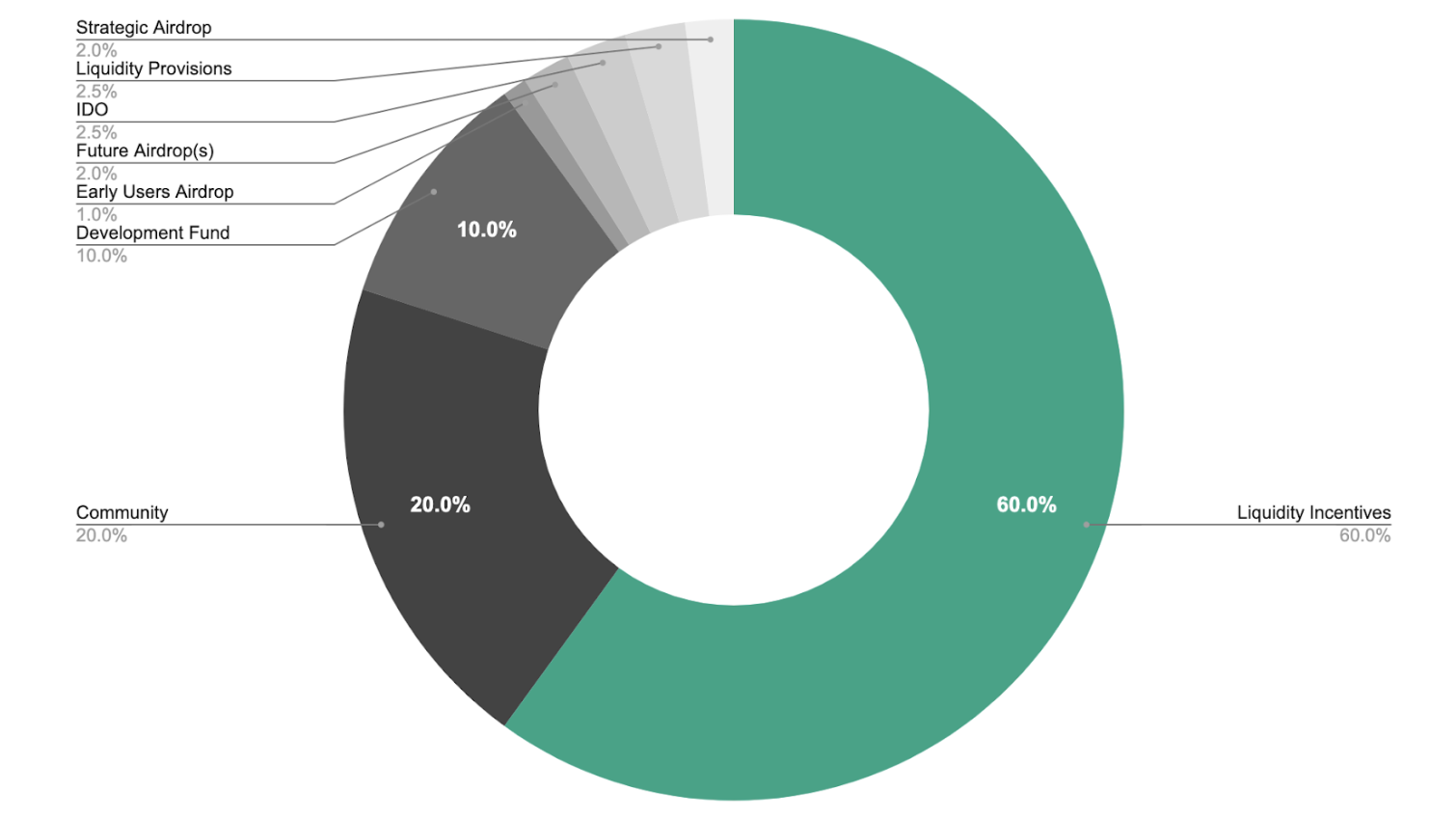

The core governance token for the RHEA protocol is REF, which also enables revenue sharing. Total supply is capped at 100 million REF tokens, distributed as follows:

Liquidity Incentives (60%)

The majority of tokens are allocated to users who actively trade or provide liquidity. Distribution occurs over four years, with the highest allocation in the first year and tapering annually—rewarding early engagement and sustained contribution.Protocol Treasury (20%)

Reserved for future protocol growth and ecosystem funds. No rigid vesting schedule—the DAO flexibly allocates funds for strategic partnerships, market expansion, or major technical development.Development Fund (10%)

Supports ongoing protocol development, technical upgrades, and open-source work. Linear vesting over four years guarantees stable, long-term team support.Early User Airdrop (1%)

Rewards early adopters and contributors. Tokens unlock after a three-month cliff and are distributed linearly over the next three months.Future Airdrops (2%)

Reserved for potential community rewards or marketing. Details and timing are determined and published by the DAO.Initial DEX Offering (IDO) (2.5%)

Held via auction on Skyward Finance in July 2021, facilitating early fundraising and wide governance token distribution.Liquidity Reserve (2.5%)

Used to seed protocol-owned liquidity pools, stabilizing market trades and supporting early asset swaps.Strategic Airdrop (2%)

Incentivizes partners, key contributors, and ecosystem projects, driving collaborative protocol growth.

(Source: guide.rhea)

The distribution framework intentionally balances early protocol momentum, community participation, and long-term development sustainability. It reflects Rhea Finance’s commitment to community-first and enduring value-driven governance.

To explore more Web3 insights, click to register: https://www.gate.com/

Summary

Rhea Finance unifies core functionality and protocol infrastructure to deliver a flexible, modular, and highly composable financial platform. Whether you’re a developer, trader, liquidity provider, or governance participant, Rhea Finance serves as a premier Web3 hub for deep engagement. As NEAR’s chain abstraction and AI integrations come online, Rhea is positioned to become a pivotal bridge in the next wave of DeFi resurgence—turning NEAR’s full potential into reality.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025