- Topic

15k Popularity

277k Popularity

12k Popularity

2k Popularity

882 Popularity

- Pin

- 💞 #Gate Square Qixi Celebration# 💞

Couples showcase love / Singles celebrate self-love — gifts for everyone this Qixi!

📅 Event Period

August 26 — August 31, 2025

✨ How to Participate

Romantic Teams 💑

Form a “Heartbeat Squad” with one friend and submit the registration form 👉 https://www.gate.com/questionnaire/7012

Post original content on Gate Square (images, videos, hand-drawn art, digital creations, or copywriting) featuring Qixi romance + Gate elements. Include the hashtag #GateSquareQixiCelebration#

The top 5 squads with the highest total posts will win a Valentine's Day Gift Box + $1 - 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

1️⃣ #TokenOfLove# | Festival Ticket Giveaway

Cheer for your idol on Gate Square! Pick your favorite star — HyunA, SUECO, DJ KAKA, or CLICK#15 — and post with SingerName + TokenOfLove hashtag to win one of 20 music festival tickets.

Details 👉 https://www.gate.com/post/status/13217654

2️⃣ #GateTravelSharingAmbassadors# | Share Your Journey, Win Rewards

Gate Travel is now live! Post with the hashtag and sha - 🎤 Cheer for Your Idol · Gate Takes You Straight to Token of Love! 🎶

Fam, head to Gate Square now and cheer for #TokenOfLove# — 20 music festival tickets are waiting for you! 🔥

HyunA / SUECO / DJ KAKA / CLICK#15 — Who are you most excited to see? Let’s cheer together!

📌 How to Join (the more ways you join, the higher your chance of winning!)

1️⃣ Interact with This Post

Like & Retweet + vote for your favorite artist

Comment: “I’m cheering for Token of Love on Gate Square!”

2️⃣ Post on Gate Square

Use hashtags: #ArtistName# + #TokenOfLove#

Post any content you like:

🎵 The song you want to he - ✈️ Gate Square | Gate Travel Sharing Event is Ongoing!

Post with #Gate Travel Sharing Ambassadors# on Square and win exclusive travel goodies! 💡

🌴 How to join:

1️⃣ Post on Square with the hashtag #Gate Travel Sharing Ambassadors#

2️⃣ You can:

Share the destination you most want to visit with Gate Travel (hidden gems or hot spots)

Tell your booking experience with Gate Travel (flights/hotels)

Drop money-saving/usage tips

Or write a light, fun Gate Travel story

📦 Prizes:

🏆 Top Ambassador (1): Gate Travel Camping Kit

🎖️ Popular Ambassadors (3): Gate Quick-Dry Travel Set

🎉 Lucky Participant

Metaplanet Buys $93M Bitcoin, Increases Total Holdings To 18,888 BTC

Metaplanet, a Tokyo-listed public company, disclosed its latest batch of Bitcoin (BTC) purchases this Monday. According to its recent filing, it acquired 775 BTC for around $93 million between August 12 and 18.

The amount translates to an average of $120,006 per BTC, which is already near the premier cryptocurrency asset’s $124,457.12 all-time high achieved on August 14. Nevertheless, the event led to Metaplanet growing its haul to 18,888 BTC.

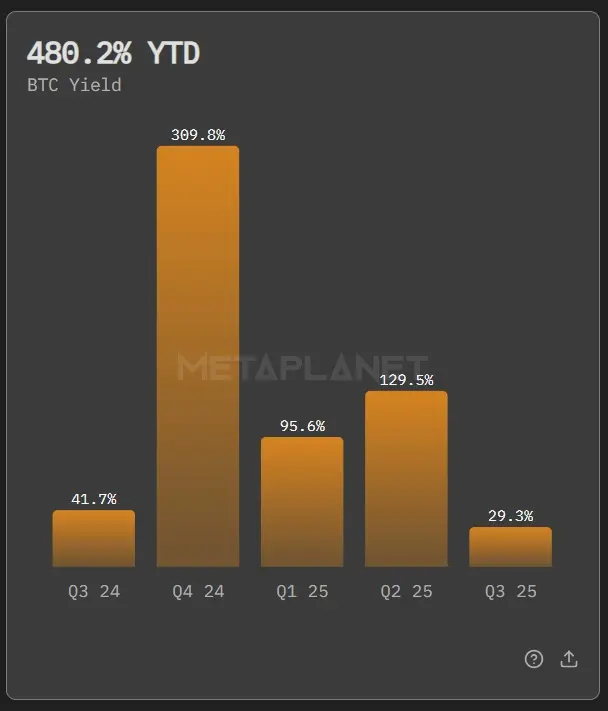

Meanwhile, the latest acquisition increased Metaplanet’s BTC yield to 480.2% year-to-date. BTC yield is a key performance indicator (KPI) representing the percentage change in the ratio of the company’s Bitcoin treasury to its fully diluted shares outstanding.

ADVERTISEMENT Metaplanet Bitcoin Yield (Source: Metaplanet)To date, the Japanese firm has invested $1.94 billion in its Bitcoin buying spree. The amount is equivalent to $102,653 per BTC.

Metaplanet Bitcoin Yield (Source: Metaplanet)To date, the Japanese firm has invested $1.94 billion in its Bitcoin buying spree. The amount is equivalent to $102,653 per BTC.

555 Million Plan of Metaplanet

Debt issuances mainly fueled Metaplanet’s aggressive Bitcoin accumulation, similar to Strategy’s (formerly MicroStrategy) playbook. Its ongoing Bitcoin Treasury Operations align with its “555 Million Plan,” which aims to raise ¥770.9 billion (around $5.4B) in capital to sustain its BTC buying program. Company CEO Simon Gerovich noted that the move marks Asia’s largest-ever equity raise dedicated to Bitcoin.

Last June, the Tokyo-listed entity revealed its ultimate plan of capturing at least 210,000 BTC by 2027. The figures comprise 1% of Bitcoin’s 21 million supply cap. At this rate, the numbers are still far from the company’s goal, but it expects to lock in up to 30,000 BTC for the 2025 fiscal year.

ADVERTISEMENTMetaplanet now ranks seventh among the world’s top public Bitcoin treasury companies. It is currently squeezed between Riot Platforms’ 19,239 BTC stash and Trump Media & Technology Group’s 15,000 BTC holdings.

Bitcoin Performance

As of 6:00 AM UTC on Monday, Bitcoin continued its dip to $115K, showing a roughly 3% decline from a $118,595.78 peak in the last 24 hours. Analysts attribute the trend to the continuation of a massive profit-taking since BTC logged a new all-time high last week. The situation resulted in the breach of the key support zone at $118K, catalyzing further sell-offs and liquidations, especially in leveraged positions.

ADVERTISEMENT