30% APY? Deep Dive into Vectis JLP’s Multi-Layered Hedging Strategy on Hyperliquid

Preface

On August 20, HyperliquidFR released data showing that Hyperliquid achieved the highest per-employee revenue in the world, with annual revenue per employee of $102.4 million. The source of these extraordinary profits is high-frequency trading activity by a massive user base. Attracting these users requires superior platform performance and consistently outstanding funding rates over time.

Serving as a DeFi yield amplifier, Vectis Finance seized this opportunity to launch the JLP HyperLoop Vault. By establishing hedged positions on Hyperliquid, Vectis simultaneously locks in price risk and steadily captures substantial funding fees. Combined with Jupiter’s newly launched JLP Loans—which offer borrowing rates as low as 5%—this approach enables low-cost lending. Recursive leverage allows users to accumulate more JLP.

This multi-pronged strategy delivers a powerful “low-cost leveraged yield + high funding fee income” dual engine, amplifying JLP returns across multiple layers—a textbook example of maximizing a unique opportunity.

The Origin and Evolution of JLP

What is JLP? JLP is the core liquidity token of Jupiter, the largest liquidity and trading aggregator on Solana. As one of the most prominent DeFi assets of the year, JLP has become the top on-chain entry point for large-scale capital seeking returns. With $1.85 billion in liquidity, more than tripling in value within a year, and a current annualized return of 29.71%, JLP combines stability and continuous growth in a truly compelling way.

JLP supports traders by providing liquidity pools for opening positions and lending, acting as the market counterparty. JLP generates returns from three primary sources:

· High Fee Distribution: JLP receives 75% of open/close position fees, price impact fees, borrowing fees, and trading fees, delivering stable cash flow.

· Diversified Asset Appreciation: JLP functions as an index fund made up of SOL, ETH, WBTC, USDC, and USDT, balancing volatility resistance with potential for growth.

· Trader P&L Capture: By acting as a counterparty, JLP benefits from overall market volatility.

Unlike governance tokens driven by market sentiment or purely speculative assets, JLP’s value is grounded in actual trading revenue and real asset appreciation. Many arbitrageurs use looping strategies to amplify their yields on JLP tokens.

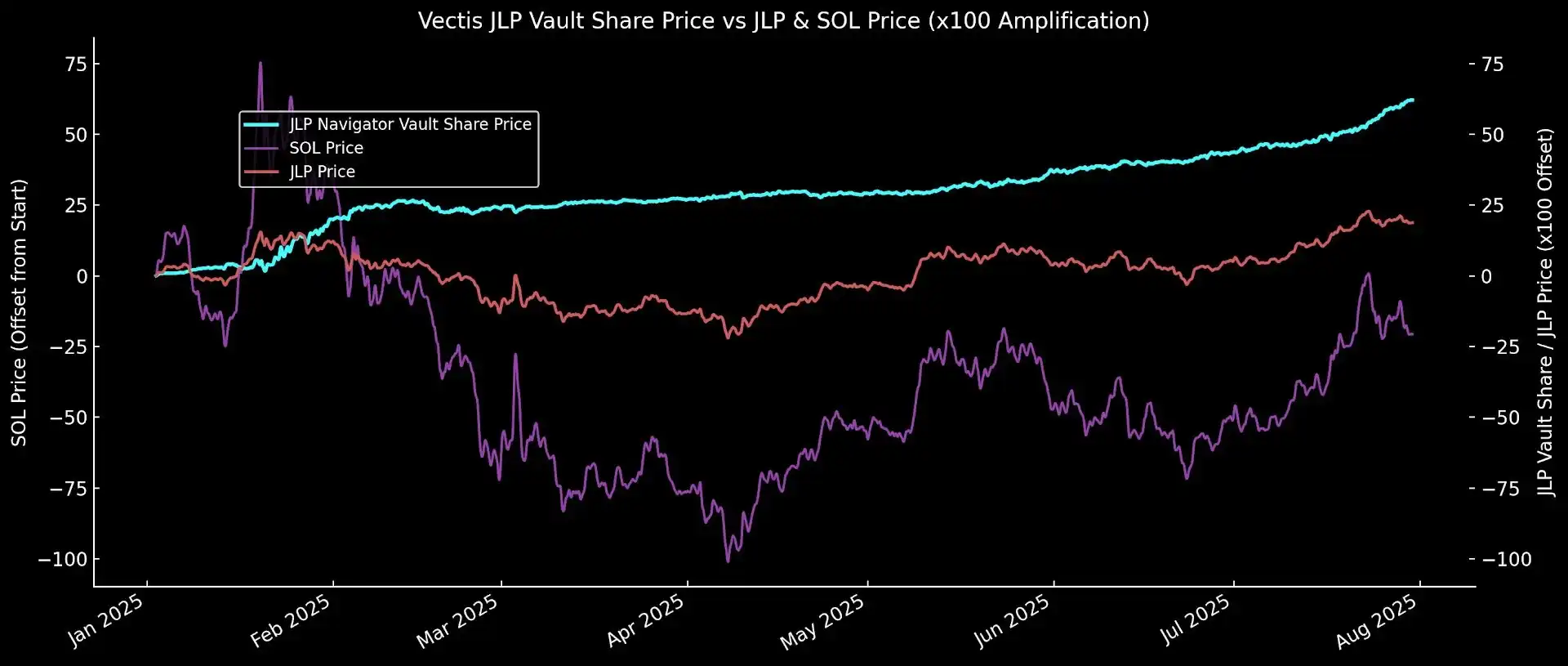

However, JLP still saw a maximum drawdown of 30% during March–April 2025, raising market concerns—primarily due to a downturn in SOL market conditions. With effective hedging in place to mitigate price swings, JLP could become a truly high-quality, low-risk yield strategy.

Vectis’ Innovative Strategy: Multiplying JLP Returns Across Dimensions

In November 2024, Vectis Finance introduced its innovative JLP Navigator vault strategy, deploying it on Drift, Solana’s perpetual contract exchange. This solution focuses on hedging price volatility while efficiently amplifying JLP’s returns. The strategy rests on two main pillars:

· Precision Hedging: Through hedging, the strategy effectively limits asset pool drawdowns and delivers boosted returns whenever the funding rate environment is favorable.

· Low-Leverage Yield Amplification: By employing 2x–3x low-leverage recursive lending, the strategy scales up JLP positions to multiply yield and fee revenue.

By multiplying JLP value and funding fees by 2–3 times, the Navigator strategy creates a robust moat for stable earnings. According to official Vectis data, it has delivered a 30-day annualized yield (APR) of about 30%, with an impressive annualized Sharpe ratio of 5.86.

Vectis Finance is an independent DeFi protocol on Solana that turns market volatility into an investment opportunity. The team pioneered the JLP yield amplification vault, reaching a peak TVL of $30 million. Building on that, the protocol expanded into funding rate arbitrage and AI-driven trading strategies, showcasing high adaptability across market cycles and earning recognition as a representative of “on-chain asset management.”

HyperLoop Vault: Taking JLP Yield Amplification Even Further

In August 2025, Vectis Finance announced the launch of the JLP HyperLoop vault strategy. This upgraded solution builds on JLP Navigator, shifting hedging from Drift to Hyperliquid for even more efficient yield amplification. The approach is as follows:

1. Low-Cost Leveraged Yield

Users deposit USDC into Vectis vaults, which is first used to purchase JLP on Jupiter. The vault then borrows more USDC using JLP Loans, reinvesting it into JLP to create a recursively leveraged position. This approach builds a low-leverage position in a yield-generating LP token and amplifies returns from both trading fees and Jupiter ecosystem incentives.

JLP Loans is Jupiter’s new lending product, allowing JLP holders to borrow USDC at rates as low as 5%—less than half the cost of other platforms.

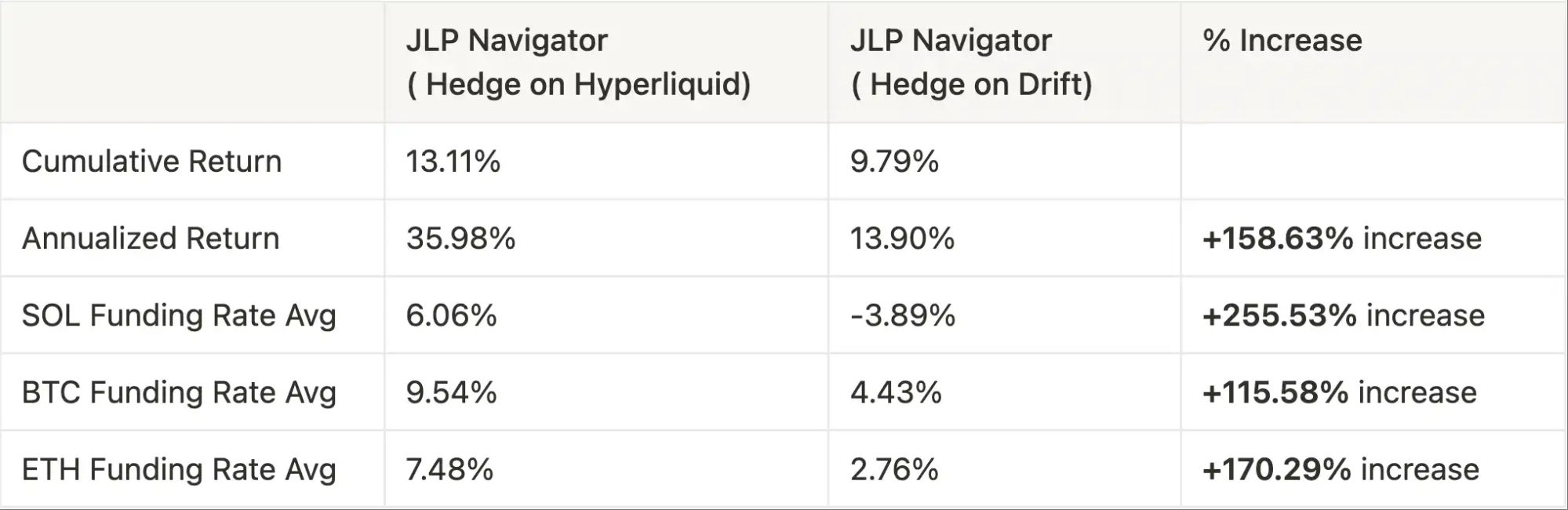

According to Jupiter’s JLP Loans site, the current borrowing rate is approximately 5.31%, less than half the average rate offered by Drift under the original JLP Navigator strategy, which averaged 10.39% between March 12 and July 25.

2. Increased Funding Fee Yield

To hedge against price volatility, the vault maintains a delta-neutral position: Vectis simultaneously opens short positions in SOL, ETH, and BTC on Hyperliquid to mirror JLP’s underlying asset composition. Automated trading systems continuously monitor and adjust these positions in real time.

When Hyperliquid’s funding rate is positive, these short positions generate additional yield, further boosting overall returns. Compared with hedging on Drift, moving to Hyperliquid has increased annualized funding rate returns by 158.63%.

Furthermore, when executing hedging on Hyperliquid, the strategy prioritizes using limit orders when conditions allow—minimizing slippage and reducing rebalancing costs, especially during highly volatile periods.

3. Security and Infrastructure

Cobo’s MPC wallet secures user funds in the JLP HyperLoop vault. Cobo, an industry leader in institutional-level digital asset custody and wallet infrastructure, provides robust security for all asset transfers and wallet operations. Unlike many DeFi vaults that depend on multisig wallets or in-house systems, HyperLoop leverages Cobo’s MPC approach to reduce single-point private key failure risk and safeguard funds using industry-leading security practices.

On the operational side, mature and audited platforms such as Jupiter and Hyperliquid process all smart contract interactions. At the same time, Vectis’ in-house automated infrastructure handles rebalancing, hedge management, and position monitoring—reducing human error and increasing operational efficiency.

Additionally, during the new vault strategy’s rollout, Vectis launched the Boost Station campaign, rewarding users who earn JLP yields with additional USDC bonuses through participating in the vault.

Conclusion

Vectis seized the JLP opportunity, using a dual engine of low-cost leverage and high funding rates to magnify profits and outpace the market. This is just the tip of the iceberg when it comes to successful cases.

In DeFi, Vectis fully understands the philosophy: build on real profits, prioritize safety, and drive innovation through high-frequency iteration—turning complex strategies into simple, reliable growth.

Looking ahead, as a next-generation leader in on-chain asset management, Vectis will continue exploring the highest-potential high-alpha opportunities, enabling large capital to enjoy reliable, sustainable, and explosive DeFi growth curves.

Disclaimer:

- This article is republished from BlockBeats. The original author of this article is [Vectis Finance]. For any concerns about republication, please contact the Gate Learn team for prompt handling via the appropriate channels.

- Disclaimer: The views and opinions in this article represent the author’s personal perspective only and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team. Without mentioning Gate, translated articles may not be copied, distributed, or plagiarized.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge