Building for crypto-native vs. building for crypto-adjacent

It’s 2025 and crypto is going mainstream. The GENIUS Act was signed into law and we finally have clear stablecoin regulation. Establishment institutions are adopting crypto. Crypto won!

As crypto crosses the chasm, what this means for early-stage venture is we’re starting to see more crypto-adjacent projects than crypto-native projects. Crypto-native means projects built by crypto experts for crypto experts, and crypto-adjacent means projects using crypto in other bigger industries. This is the first time I’ve seen this shift happen in my career, and I want to discuss the key differences in what matters when building for crypto-native vs. building for crypto-adjacent.

Building for crypto-native

The most successful crypto products to date have almost all been built for crypto-natives: Hyperliquid, Uniswap, Ethena, Aave, etc. Like any fringe cultural movement, crypto has been such an avant-garde technology that people outside the crypto-native bubble didn’t “get it” and couldn’t be passionate daily active users. Crypto-native degens grinding in the trenches were the only ones with the risk tolerance willing to get their hands dirty beta testing every new product and surviving hacks, rug pulls, and more.

Traditional Silicon Valley VCs passed on crypto-native projects because they thought the TAM for crypto-natives was too small.1 And rightfully so, it was still super early for crypto. There were barely any onchain apps back then, and the term “DeFi” wasn’t even coined until October 2018 in an SF group chat. But you had to take a leap of faith and pray that the macro tailwinds would eventually come and dramatically increase the TAM for crypto-natives. And sure enough, 2020 DeFi summer yield farming combined with 2021 ZIRP era saw the market for crypto-natives balloon, and suddenly every Silicon Valley VC was FOMOing into crypto and picking my brains to get them up to speed with what they missed the last four years.

Fast forward to today, the TAM for crypto-natives is still quite small compared to non-crypto markets. I estimate the size of crypto Twitter to be in the tens of thousands max. As a result, in order to generate nine figures in annual run rate (ARR), the average revenue per user (ARPU) needs to be very high. Which leads to the following important truth:

Crypto-native is all about building for power users.

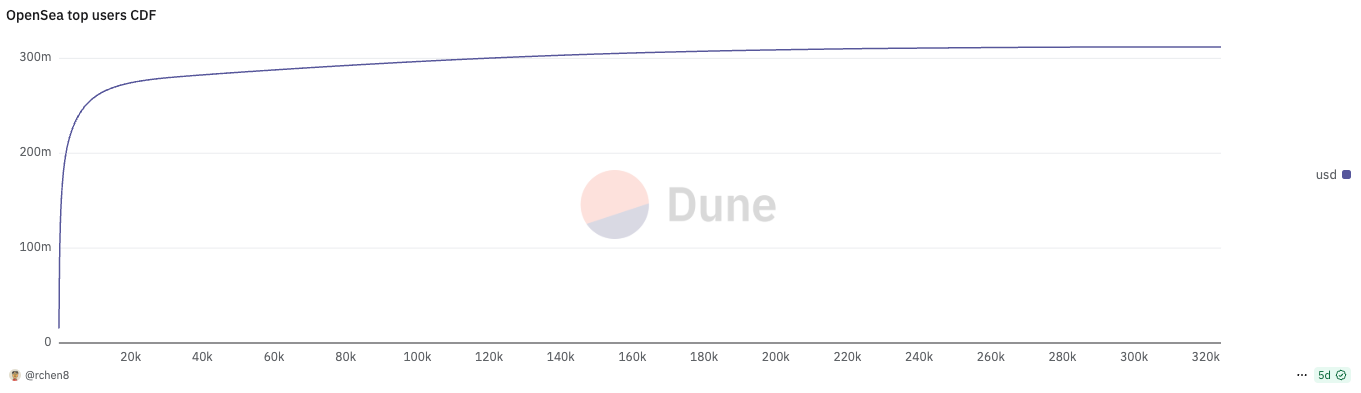

Every successful crypto-native product has an extreme power law distribution in usage. The top 737 users (top 0.2%) did half of OpenSea’s volume last month. The top 196 users (top 0.06%) did half of Polymarket’s volume last month!

As the founder of a crypto-native project, what should be keeping you up at night is retaining your top power users, not onboarding more users. This is contrary to Silicon Valley conventional wisdom, which focuses on top-line user growth like number of daily active users (DAU).

User retention in crypto has historically been difficult. Power users tend to be mercenary and respond well to incentives. This makes it easy for an upstart competitor to come out of nowhere and eat into your market share by simply poaching a handful of your top power users. Look at Blur and OpenSea, Axiom and Photon, LetsBonk and Pump.fun, etc.

All this is to say that there is way less defensibility in crypto than in web2, coupled with everything being open-source and easily forkable. Crypto-native projects come and go and rarely last more than a cycle, or even a couple of months.2 Founders who get rich after their TGE are tempted to quiet quit their project and start angel investing as a retirement gig.

The only moat for retaining power users is to keep innovating on product and stay one step ahead of competitors. Uniswap is still able to stay relevant after seven years by constantly shipping new 0 to 1 product features that keep their power users happy: V3 concentrated liquidity, UniswapX, Unichain, V4 hooks. And that’s despite building a DEX, the most crowded and competitive market of all crowded and competitive markets.

Building for crypto-adjacent

There have been many attempts in the past at leveraging blockchain technology for bigger real-world markets such as supply chain management or bank-to-bank payments but all have failed because it was too early. Fortune 500 companies experimented with blockchains in their R&D innovation labs but weren’t serious enough to actually use them in production at scale. Remember the catch phrases “blockchain not Bitcoin” and “distributed ledger technology”?

Today we’re seeing incumbents doing a complete 180 pivot on crypto. Big banks and big businesses are launching their own stablecoins. Regulatory clarity under the Trump administration opened the overton window for mainstream adoption of crypto. Crypto is no longer the unregulated wild west of finance.

For the first time ever in my career I’ve started seeing more crypto-adjacent projects than crypto-native projects. And for good reason too, as the biggest outcomes the next few years may very likely be crypto-adjacent rather than crypto-native. IPOs are opening in the tens of billions, whereas TGEs are capped in the hundreds of millions to single digit billions. Examples of crypto-adjacent projects include:

- Fintech company that uses stablecoins for cross-border payments

- Robotics company that uses DePIN incentives for data collection

- Consumer company that uses zkTLS to authenticate private data

The common theme here is that crypto is a feature not the product.

Power users still matter for sure but are less extreme in crypto-adjacent industries. When crypto is merely a feature, success has very little to do with crypto but more with being a deep expert in the crypto-adjacent industry and knowing what matters. I’ll use fintech as an example.

Fintech is all about getting distribution with good unit economics (CAC/LTV).3 New crypto fintech startups today live in perpetual fear that a more established non-crypto fintech company with much bigger distribution will add crypto as a feature and crush them or drive up CAC to make it impossible to compete. And unlike crypto-native projects, they can’t get bailed out by launching a token that trades well from the narrative.

The irony is that crypto payments has been an unsexy category to build in for a very long time; I even said this on stage during Permissionless 2023! But pre-2023 was the perfect time to start a crypto fintech company and get a head start building up distribution. After the Stripe acquisition of Bridge, we’re now seeing crypto-native founders pivot from DeFi to payments, but they’re inevitably going to get killed by ex-Revolut employees who know how to execute the fintech playbook.

What does crypto-adjacent mean for crypto VCs? It’s important to not adversely select founders that non-crypto specialist VCs all pass on because crypto VCs are the suckers who don’t understand the crypto-adjacent industries well enough. A lot of this adverse selection comes from picking crypto-native founders who made a recent pivot to crypto-adjacent. The uncomfortable truth is that on average crypto tends to be an adverse selection of founders who couldn’t make it in web2 (though the top decile of crypto founders is very different).

Historically a good source of founder arbitrage for crypto VCs is finding talent that comes outside of the Silicon Valley network. They don’t have polished resumes (e.g. Stanford, Stripe) nor pitch well to VCs but deeply understand crypto-native culture and building a passionate online community. Hayden got laid off from his Siemens mechanical engineering job and built Uniswap as a way to learn Vyper. Stani built Aave (fka ETHLend) while he was still finishing up law school in Finland.

The founder archetype for successful crypto-adjacent projects will be very different from that of crypto-native projects. Not the wild west financial cowboy who understands crypto-native degens very well and can create a cult of personality around themself and their token network. But rather a more polished commercially-minded founder who likely comes from their crypto-adjacent industry and has a unique go-to-market strategy for getting distribution. The crypto industry has finally matured and grown up, and so too are the next batch of successful founders.

1. The Telegram ICO in early 2018 was a good example of the dichotomy between how Silicon Valley VCs and crypto-native VCs think. Kleiner Perkins, Benchmark, Sequoia, Lightspeed, Redpoint, and others invested because they thought Telegram had the users and distribution to be the dominant app platform. Whereas almost all crypto-native VCs passed.

2. I have the contrarian view that crypto isn’t lacking consumer apps. Rather, the vast majority of consumer projects are not venture-backable businesses because revenue is not sticky. For these businesses, founders should not raise VC money but should instead bootstrap and find a way to be profitable. Then keep trying to capitalize on the current consumer fad to print money for a few months before the zeitgeist shifts.

3. Nubank had an unfair advantage because they were first to the category before the term “fintech” was well defined. Likewise they were just competing against the incumbent big banks in Brazil for users rather than against other fintech startups. Brazilians were so fed up with their existing banks that they immediately switched to Nubank when the product launched, giving Nubank the rare combination of both near zero CAC and product-market fit.

4. If you’re building a stablecoin neobank for emerging markets, why are you living in SF or NY? You need to be on the ground talking to users in these countries. This is surprisingly a good first filter for pitches.

Disclaimer:

- This article is reprinted from [Shower Thoughts]. All copyrights belong to the original author [Richard Chen]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge