This is absolutely MASSIVE for the agent economy.

@wardenprotocol just hit 400K+ daily users and proved crypto agents have real product-market fit.

Now they’re doubling down with their updated manifesto.

Instead of building infrastructure and hoping users come, they flipped the script:

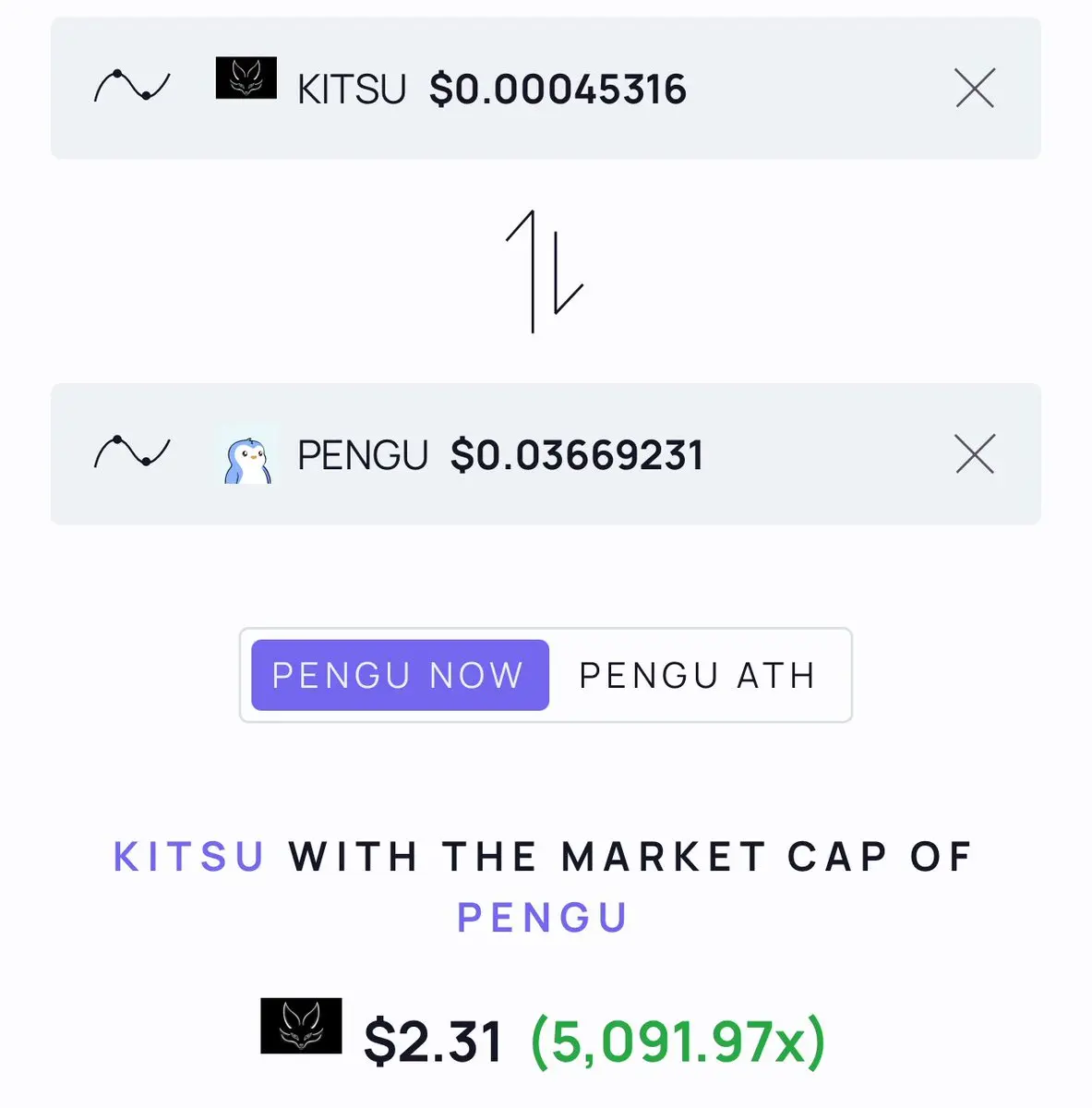

> Win users first with agents that make crypto 10x easier

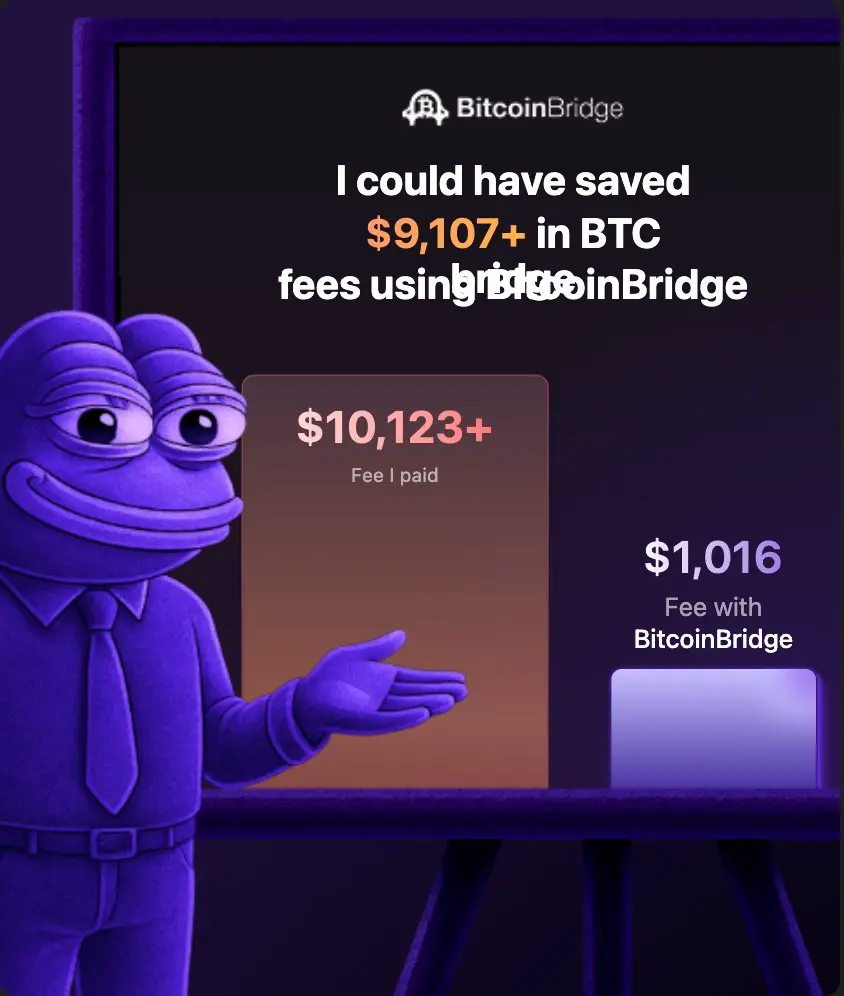

> Prove PMF by solving crypto’s broken UX

> Open the rails so anyone can build and monetize agents

1.5M daily chats powering agents trading, staking, bridging, creating NFTs is genuinely insane.

And all that through natural language.

This is the infrast